A requirement to register for PRODA to access HPOS looks innocent but it could be nasty for many practices and contracted GPs.

A requirement to register for PRODA to access HPOS looks innocent enough but it’s the first step in a long line of tax structure grief for most practices and a lot of independently contracted GPs

From the 13th of next month, the way doctors transmit data to the Department of Human Services is meant to be via new web services, compatible software and a PRODA account.

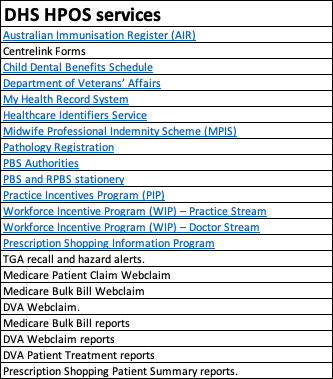

This includes making Medicare claims and accessing Eclipse and the many online services in HPOS (Health Professional Online Services).

PRODA (provider digital access) is an online authentication system that Services Australia is starting to use to verify the identity of users who want to access important government online services.

As things go, 13 March won’t be happening because most of the software vendors aren’t ready. The changes to patient management software, particularly for non-cloud-based vendors, which is what most GPs use, are not trivial, and the government paid the vendors virtually nothing to make the changes.

Our largest patient-management system, Best Practice, has asked for and received a three-month extension to the deadline, which of course means any practices using the software have the extension as well.

Most GPs and practices won’t recognise how important this short stay in proceedings might be to them in getting more organised around PRODA.

That’s because most GPs, practices and their software vendors haven’t yet joined the dots on the new PRODA system in terms of its ability to expose tax structures in GP practices –which may not cut the mustard for both the ATO in terms of proper invoicing practices, and the state revenue offices, in terms of payroll tax.

It is increasingly looking like the DHS, in seeking to make things much more efficient for themselves technically, are encouraging their clients (the many doctors and practices across the country) to join up to a new system, which ultimately will lay bare potentially non-compliant financial structures to both the ATO and state government revenue bodies.

The DHS doesn’t look like it understands what it is actually bringing upon the medical profession in its PRODA change.

It says in one of its information pages on its website: “You won’t need to register your organisation in PRODA if your software developer will authenticate for you.”

This is a reference to the technical ability of cloud-based software patient management system providers, such as Clinic to Cloud or Medirecords, to use their own PRODA account to process all the Medicare and DVA claims of its clients.

Neat and technically feasible, but probably not tax compliant for a large swathe of medical practices.

Also fairly meaningless, for most GP practices anyway, because all practices will need PRODA to access HPOS (see table below), which features a laundry list of online services that all practices will need to access at one point or another to conduct normal business.

Most GP practices don’t use cloud-passed PMS software anyway. If you are using one of the big non-cloud vendors such as Medical Director or Best Practice, a PRODA account will be needed for each location the software is operating.

But that’s not even close to the start of the problem for most GP practices.

The way Medicare billing works is that if the doctor is an independent contractor, they should be charging the patient using an invoice with their ABN on it, and the money should remit to their own ABN-linked bank account. After that, a practice can charge a commission on that consult to that contractor for “rent” and “services” provided by the practice.

If a doctor is an employee of a practice, then the practice can make the claim on the practice ABN.

That’s not how a lot of GP practices are working in the real world.

Have you ever seen an invoice issues by GP practice to a client even?

Until PRODA, such detail hasn’t really been a huge issue, because all these transactions and how they flow have largely been invisible, without a tax office audit.

PRODA presents a few big problems for the future for both practices and independently contracted GPs.

Firstly, PRODA says that an organisation or entity can register and requires the ABN number of that entity.

But you aren’t entitled to make a Medicare claim using a different ABN to the entity that performed the service. In the case of an independently contracted doctor, the Medicare claim can be made only by the doctor performing a consult, using their ABN number, and an ABN linked bank account.

This rule should imply that every independently contracted doctor now needs their own PRODA account.

If you think back to the DHS saying that you won’t need a PRODA account if your software vendor has one, it looks a lot like the DHS has not contemplated any of the financial or tax consequences of what they are recommending practices and doctors do in respect to PRODA.

It gets worse.

It looks like someone might have a long-term plan inside DHS.

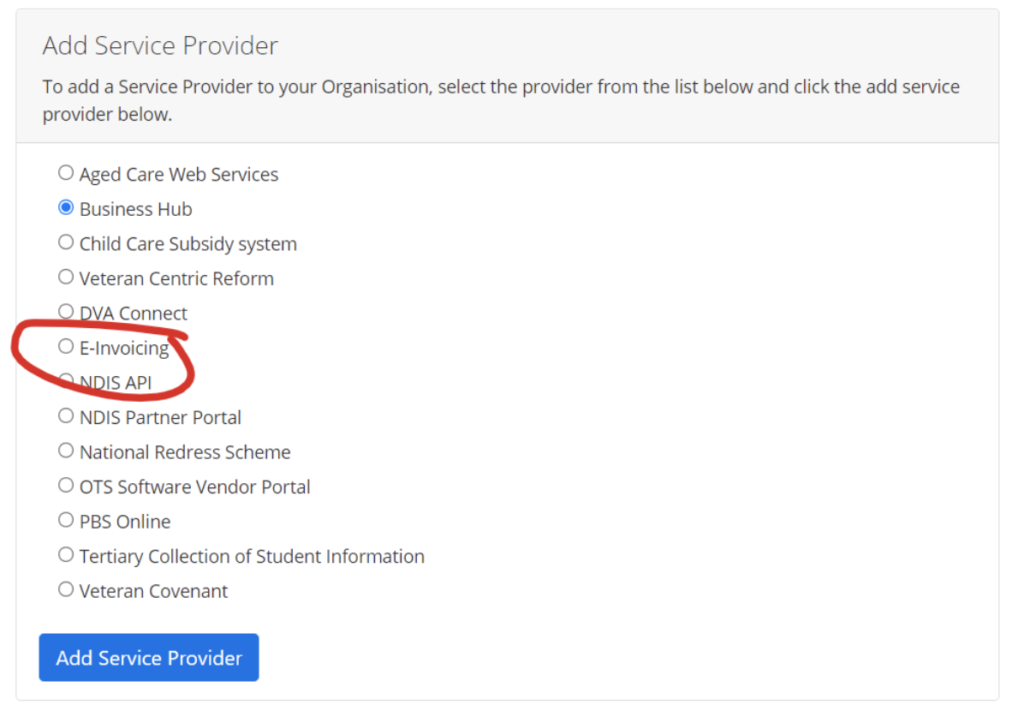

When you trawl through the PRODA documentation and workings in detail, as David Dahm, of Health and Life advisory did on behalf of his clients recently, you find that one of the available services to link to is e-invoicing.

This isn’t something someone other than a specialised accountant for medical practices is likely to get excited about.

Dahm told The Medical Republic that the existence of that tick box in the PRODA form sent a chill down his spine.

“Although e-invoicing isn’t mandated at this point, putting it in PRODA like this means the government can press the button on it whenever it likes.

“They aren’t likely to make it enforced any time soon, but it would be easy for them to make it next to impossible for a practice or a doctor to get paid quickly and effectively without using e-invoicing.

“You could look at that e-invoicing tick box for now as a sort of trap door.”

What’s the problem with e-invoicing?

E-invoicing would provide the government with a detailed footprint of every transaction of a practice, and, theoretically, all its contracted doctors.

At the federal and state level, data-matching services on an intra- and inter-departmental basis are increasing in use a lot.

If an e-invoicing footprint isn’t one that aligns with current ATO practice, or perhaps more relevantly, given what is going on now with state governments, payroll tax requirements, then practices might become exposed in a systematic manner.

The vast majority of GP practices are not set up to have their individual contractors to make a Medicare claim using their own ABN linked bank account, and then charge them after the fact for their “rental” of space and infrastructure.

Most often, the money from a consult is transacted by the practice on behalf of the contractor, often with a practice ABN (some are smart enough to use the contractor doctor ABN), and flows to a practice first. It is then remitted to the consulting doctor, less the commission.

PRODA is not requiring any change to any functionality of how transactions are reported and made or any new information to be submitted so far, but as Dahm points out, the e-invoicing tab isn’t in there for nothing.

If a contractor doctor whose transactions are handled by their practices now doesn’t get PRODA account, how are those contractors to be seen in terms of being the ones that actually made the Medicare claim and earned the revenue in the first place?

Remember, most of this was meant to kick off on 13 March originally.

If, by the way, e-invoicing is switched on in some way by the DHS in the near future, none of the software vendors are likely to be ready for that. It would mean that a practice had to store the independent contractor transaction, with its ABN, and bank details, and the software pulling that information out and organising it.

Looking at all the forms and documentation issued by the DHS for PRODA, it looks like the intention was that an organisation can use the unique ID of their contractors to make the claim on their behalf. Which is a bit like how the system sort of works now with a lot of practices, where the practice does the transaction on behalf of the contractor. That suggests the DHS hasn’t got much of a clue about the tax implications of what they are asking for.

It’s a technical solution without any recourse to the tax position it is setting up.

Last year, various state governments upped the ante significantly on assessing medical practices for payroll tax liability.

If all doctors who do a consult were to register for PRODA, and send their claims individually to the DHS, the new web system could easily handle that extra data load. That’s a bit of the magic of the cloud.

From a DHS perspective, the detail of this information isn’t that interesting.

But from an ATO perspective, and from a state revenue office perspective, the detail might be compelling.

With current and evolving data-matching capability, various government departments, state and federal, would be able to instantly understand which medical practices were invoicing correctly for tax and payroll tax purposes.

State revenue offices would also be able to point to the new Medicare Web Services regime, the requirement to register for PRODA with an ABN, and ask, if your doctors are really contractors, why aren’t they registered on PRODA and making their own claims on their own ABNs?

In some significant cases against GP practices so far, state government revenue offices have demanded back taxes after deciding that a structure is employer-employee rather than employer-contractor. In a recent case, that demand was for almost $1 million.

The structure that the DHS seems to be requiring is in conflict with the interpretation that various state government revenue offices are giving to the set-up of a lot of medical practices, which is not one generally of employee-employer in terms of relationship.

The tax system is conflicting with the claiming system, and departments aren’t comparing notes on what might happen to their doctor community.

It always has been conflicting to some extent, but PRODA will put this conflict up in lights.

Luckily, the March 13 deadline for PRODA and software vendor compliance is more “a stake in the ground” from the DHS than an “actual deadline”, according to sources.

“Nearly everyone is going to request a deadline extension, and get granted one”, one vendor assured us this week.

Apparently, even from a technical perspective, the enormity of the change for both vendors and providers is high on the mind of government minders, and they are aiming to give the process a lot more time.

What you’d love is they give it a bit more thought in terms of the tax implications of what they are thrusting upon doctors and practice owners.

In any case, there are at least a few more months for GP practice owners to get their head around this issue.

What would be nice is if the various colleges and the AMA, recognising the problem for how big it really is, call the Department of Health, the DHS and Services Australia, and have a good chat to them about the implications of what they are doing for a doctor community that is probably at the end of its covid-induced-stress tether.

David Dahm has written in quite a bit of detail on this and related issues on his blog HERE