Brave or stupid? Analysts think Telstra's new managers might be regretting their foray into Healthcare

Telstra Health has invested in 20 companies in two years and has been much feted as the company guiding our e-health future. It looks like it just ran aground on the isle of ‘strategic review’.

Last week’s sale of Medical Director to a private equity group may have marked the beginning of the end of Telstra’s sometimes puzzling foray into e-health. According to industry insiders, Telstra Health had been in negotiations to buy 50% of Medical Director for $50 million and start a joint venture with Primary Health Care Ltd.

Such a move would have benefited both Primary, which didn’t have the capital, know-how or assets to transform the business, and Telstra Health, whose assets to date are disparate and in dire need of something that might connect them into some semblance of a strategy.

But, according to industry sources, Telstra’s senior management decided to halt funding for their Health group following a strategic review of the business. Apparently the new management team under Andy Penn, the CEO who replaced David Thodey late last year after he retired, didn’t think Telstra Health’s current plan was any good. They asked the management team to come up with something that showed a much clearer and faster path to profitability.

Telstra Health subsequently had to pull out of the Medical Director acquisition. Primary was left with a 100% offer from Affinity which was almost impossible to refuse. That offer valued the business at $55 million more than Telstra’s bid, and while it is understood Primary was still keen on the Telstra joint venture, their requirement for short term capital and the size of the offer, meant the fate of Medical Director was sealed. (See story p14) The sudden withdrawal of funding for Telstra Health’s expansion could not have come at a worse time for the management of the group. For that past two years critics had been wondering why so many disparate and apparently unconnected businesses had been acquired. Telstra Health management had responded by promising that eventually those businesses would all be connected somehow.

Medical Director was a key piece in the puzzle. The withdrawal of funding on such a critical potential acquisition can’t have been an easy decision for senior management. The move has prompted suggestions the Telstra Health experiment may be finished.

You can’t find many analysts or industry observers who have much good to say about where the business is today.

“Telstra Health is a hodge-podge collection of disparate assets with few synergies and Telstra has not demonstrated that they have any idea what they’ve bought into. It feels like a clusterf*** now waiting to unravel,” one senior analyst told TMR.

It is understood that following the strategy review , Telstra Health management felt the goal posts had been unfairly moved. Telstra’s top brass wanted to see a much clearer path to a profitable future for the business, according to insiders.

Prior to becoming CEO, Andy Penn was Telstra’s chief financial officer. He may well have had doubts about the strategy of Telstra Health all along, but he wouldn’t have been in a position previously to call the shots.

The head of Telstra Health, Shane Solomon, was brought in about two years ago under the wing of Gordon Ballantyne, who was a David Thodey appointment. He left soon after Thodey did last year after he failed to snare the top job.

Talk is now of Solomon being “moved on”. Penn appointed a new manager over Solomon, Cynthia Whelan, who had a track record managing Telstra’s International Division. And Whelan, or the Telstra board, quickly started moving new senior people into the business, most likely with a view to change. Key among them is Tim Kelsey, former national director for Patients and Information with the NHS in England. He was also the UK government’s executive director of transparency and open data.

Apparently things are little tense in the senior ranks of Telstra Health at the moment. TMR put some questions to Cynthia Whelan about the future of the group given the industry talk. We asked:

• Is the new management of Telstra under Andy Penn considering, as a part of recent reviews of Telstra Health strategy, the idea that they will walk away from the strategy as it was developed in the last two years under Shane Solomon?

• If so, what is the new plan/strategy?

TMR got the following reply from Telstra’s media department (with a curt note requesting that we not attempt to talk directly to Telstra senior management again).

“Telstra Health is an integral part of Telstra’s growth strategy. [We continue] to develop solutions that make healthcare more convenient, at lower costs and deliver better health outcomes.

We’re continuing to invest in and grow the business to meet the needs of our customers…”

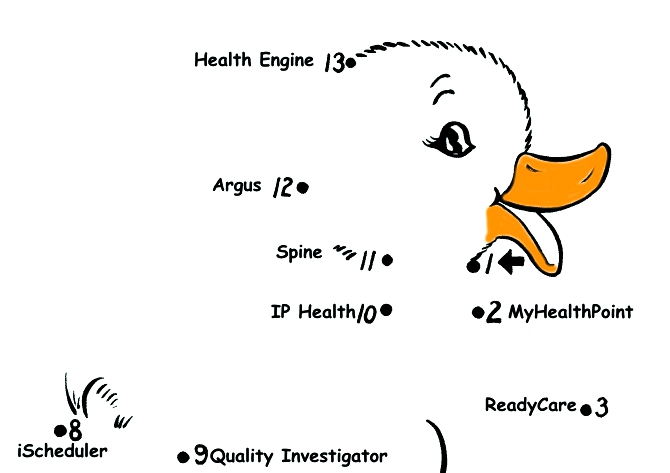

These would hardly be comforting words for the management of the 20 or so companies that Telstra Health has invested in over the past two years at a cost of over $200 million (see box below). What now for these companies if Telstra Health is going to turn left instead of proceeding as previously planned? What if, Telstra decides that Health isn’t aligning well enough with the strategy of the greater business?

Telstra Health turns over only about $80 million and is reportedly not profitable. That doesn’t look like a business that is going to change the fortunes of a $26 billion group in the near term.

Telstra Health was always seen by analysts as an experiment on the part of David Thodey. Rather than wait around and go the normal enterprise route of ‘big bang’, Thodey sanctioned Solomon to ‘dive in’ to something that the company didn’t really understand in order to get a better view of the sector.

Telstra Health touches a lot of doctors and healthcare professionals with its e-health investments. Some of these companies, such as Argus, which is one of the country’s largest secure health-messaging providers, offer services that are critical in the provision of safe healthcare. Others, such as Health Engine, are clearly about facilitating a more productive future for our healthcare professionals.

But with 20 horses in the stable, each not particularly synergistic with the others, some fully owned, others only part owned, and until now a philosophy that allowed each group a lot of freedom to manage their own destiny, it is difficult to see a quick resolution to the question of a coherent strategy.

The decision to not back the Medical Director acquisition was essentially a vote of no confidence by the senior management of Telstra in their health group and the past two years of their work.

In some respects Telstra Health is starting to look like the ill-fated digital marketing aggregations of the early dotcom era: Photon and Blue Freeway. Both these groups attempted to bring together only partly related digital marketing groups that didn’t ever have any synergies and were impossible to manage because of so many small and varied cultures.

Although Telstra Health is a $200 million punt so far, if you put that in the light of some of the Telco’s more spectacular investment failures, like for instance, the acquisition of PCCW some 15 years ago for some $3 billion that didn’t amount to anything in the end, it does feel like a venture Telstra senior management could easily choose to walk away from.