In SA and Victoria the actual bulk-billing rebates practices might get by registering for payroll tax might surprise quite a few who have signed themselves up to pay the tax.

It looks like South Australia isn’t going to count any bulk-billing incentive component in its bulk-billing rebates and Victoria is going to start including consumables costs in its calculations, which feels like the states have, one way or another, misled GPs on the true nature of their bulk-billing rebate deals by quite a bit.

This is especially so considering the scale of the new bulk-billing incentives due to start in November this year.

It took until 4 June for South Australia to properly reveal how its exemptions were calculated to signed-up practices and even then it was only in the form of a few asterisks on their calculation slide during a public webinar – see below.

No one questioned the addendums during or after the webinar, which feels like most attendees didn’t pick up the subtle but important carve-out, one which some analysts think could add up to a lot of money for individual practices over time.

It essentially means that for the current bulk-billing incentives in play – under 16s and and concession cardholders – none of the incentive additions can be clawed back, and once the bulk-billing scheme goes much bigger on 1 November to include anyone with a Medicare number, even more money will be missed being clawed back by South Australian practices.

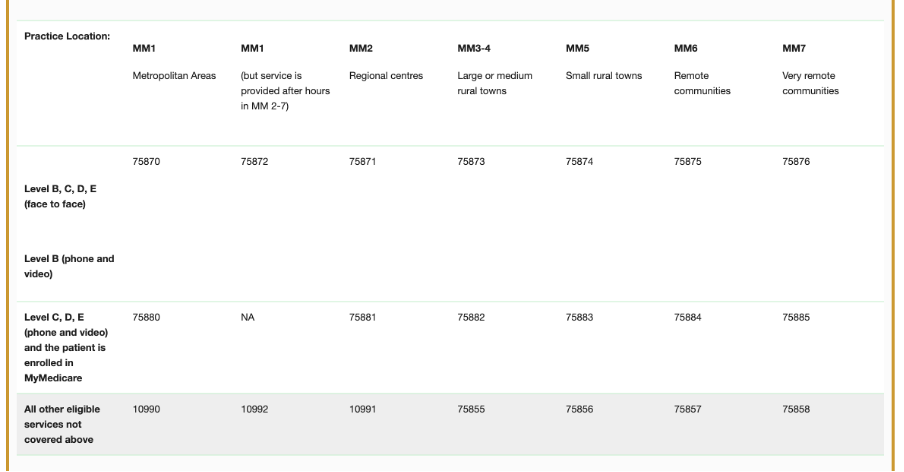

As of 1 November, all the following bulk-billing items can’t be used to claim rebates in SA:

Notably, the more rural you are, the more you are going to miss out on the new incentive. That doesn’t sound like it’s well designed as it’s entirely counter to the focus of the federal government’s intent on bulk billing.

And what you miss out on is quite a bit.

The 1 November incentives are scaled to increase substantively in regional, rural and remote communities, as determined using the Modified Monash Model and are as follows:

- Modified Monash 2 locations – 150% of value of bulk billed items in metro locations (Modified Monash 1)

- Modified Monash 3-4 locations – 160%

- Modified Monash 5 locations – 170%

- Modified Monash 6 locations – 180%

- Modified Monash 7 locations – 190%

Are the states making things up as they go?

Is 4 June, after which most practices have been lured into signing up to the scheme without this addendum, a good timeframe to be telling South Australian GPs about the change, given it all came into effect in that state on 1 July?

It feels very on the run, disorganised and certainly like no one has called the federal Department of Health, Disability and Ageing to compare notes on bulk-billing strategy.

Victoria goes outside the box on its clawback

Victoria has come up with a different means of clawing back bulk billing money on its offer, probably a lot less in net terms than SA, but a clawback none the less, which hasn’t existed in bulk-billing claiming up until now and seems entirely illogical.

On 30 June, the Victorian State Revenue Office updated its website to include new definitions for “GP Medical Business” and “relevant person.”

That update notes that “excessive consumable fees may be subject to payroll tax”, a change which is at odds with almost all payroll tax rules from every state up until now, where payroll tax could only be levied on labour.

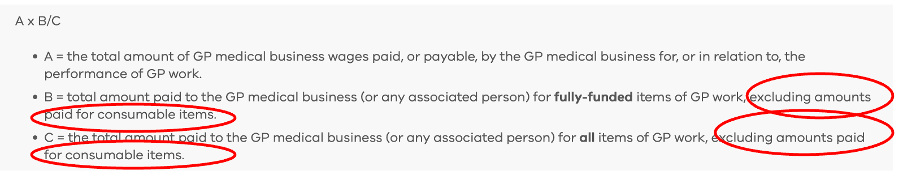

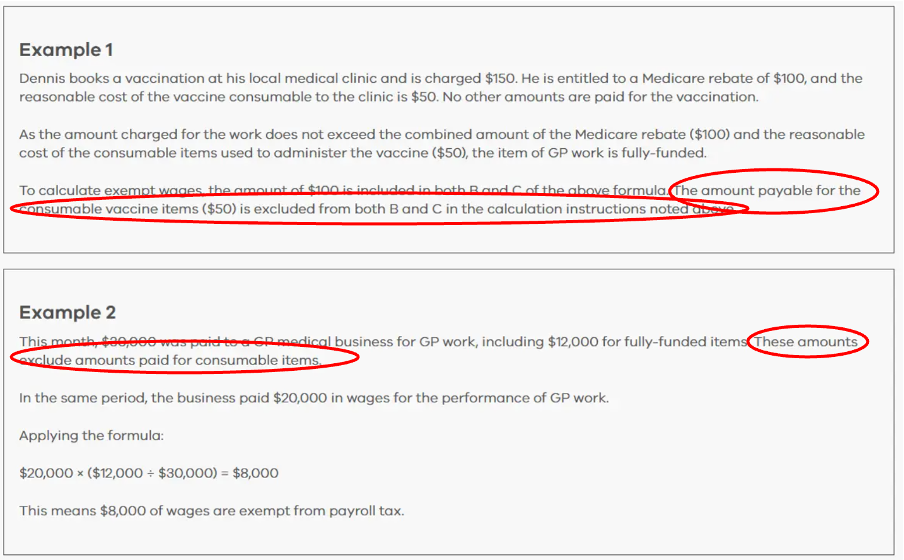

Here’s the equivalent formula provided to GPs and practice owners by the Victorian SRO recently:

And here are some Victorian SRO examples in which they make it perfectly clear that somehow some poor sod inside a GP practice’s bookkeeping function is going to need to carve consumables out of the practice’s submission (how do you do that easily?) to the Victorian SRO for a rebate.

GPs have genuine things to complain about here

There are quite a few things GP groups have justifiably to complain about here, albeit it looks too late:

- Why weren’t these exemptions made clear when the SROs were scaring practices into signing up to their payroll tax regime up to one year ago and more? In Victoria, the SRO told AGPA that there was no circumstance it could think of in which any practice in the state would not be subject to payroll tax. This statement was patently wrong and the SRO knew it because some practices had been subject to audit and passed because they had “tenant doctor structures” which exempted them.

- Why would you exempt the federal government’s payroll tax incentives full stop, other than to make more money from payroll tax for no good reason? After all, haven’t state politicians constantly stated that they want to encourage more bulk billing for their electorates as well? These two carve-outs are discouraging bulk billing and taking more state tax revenue.

- The new red tape being introduced to practices in these schemes is enormous and piles on top of the red tape these practices already have to do back flips on to meet funding requirements for the new bulk-billing incentives, day-to-day MBS billing and now constantly changing PIP requirements – the new bulk-billing incentive is going to be run via PIP – the BBPIP.

- If the SROs are so disorganised as to be making changes to the boundaries of their payroll tax rebate schemes this late in the day, what other changes might they do in the future if things aren’t working out for them.

Related

Is there a way around this mess at this late stage?

Practice advisory principal David Dahm, who has championed the “tenant doctor model” (service entity model) for some years now amid the rise of state SROs’ focus on raising new revenue via payroll tax (or using payroll tax revenue to try to force practices to bulk bill more) told The Medical Republic that the whole situation was increasingly messy.

“The more time passes the more I see practices enquiring as to whether they do meet the tenant doctor model or not, so they can try to avoid all the new complications, and the cost of being beholden to a state SROs as a declared payroll tax entity,” Dahm told TMR today.

“A lot of them are exempt, I suspect,” said.

Any practice preparing a return for the SA SRO for payroll tax purposes now encounters this new question: “Are you a designated medical practice as defined in the Payroll Tax Act 2009?”.

Mr Dahm says it’s more or less a trick question that practices need to think a lot more carefully about.

“If you tick this box or even if you refer to your practitioners as ‘Independent Contractors’ or simply ‘Independent Practitioners,’ this would suggest that you operate a ‘medical practice’ or ‘centre,’ which would likely trigger new payroll tax obligations,” he said.

“However, if you don’t tick the box and refer to your doctors as genuine ‘tenant doctors’, this typically indicates that you have an ‘administrative entity’ instead.”

There of course is no tick box for the option of “administrative entity”.

Neither is there one yet at the federal level for PRODA registration, which might be a problem for tax that gets levied by the ATO.

Which all suggests the state and even the commonwealth have some way to go to accommodating GP practice structures properly into the future.

For a deeper dive into the ramifications of the SA bulk billing incentive exemption and the Victorian addition of consumable costs to payroll tax liability, in relation to your practice/entity structure, David Dahm has written on the topic HERE