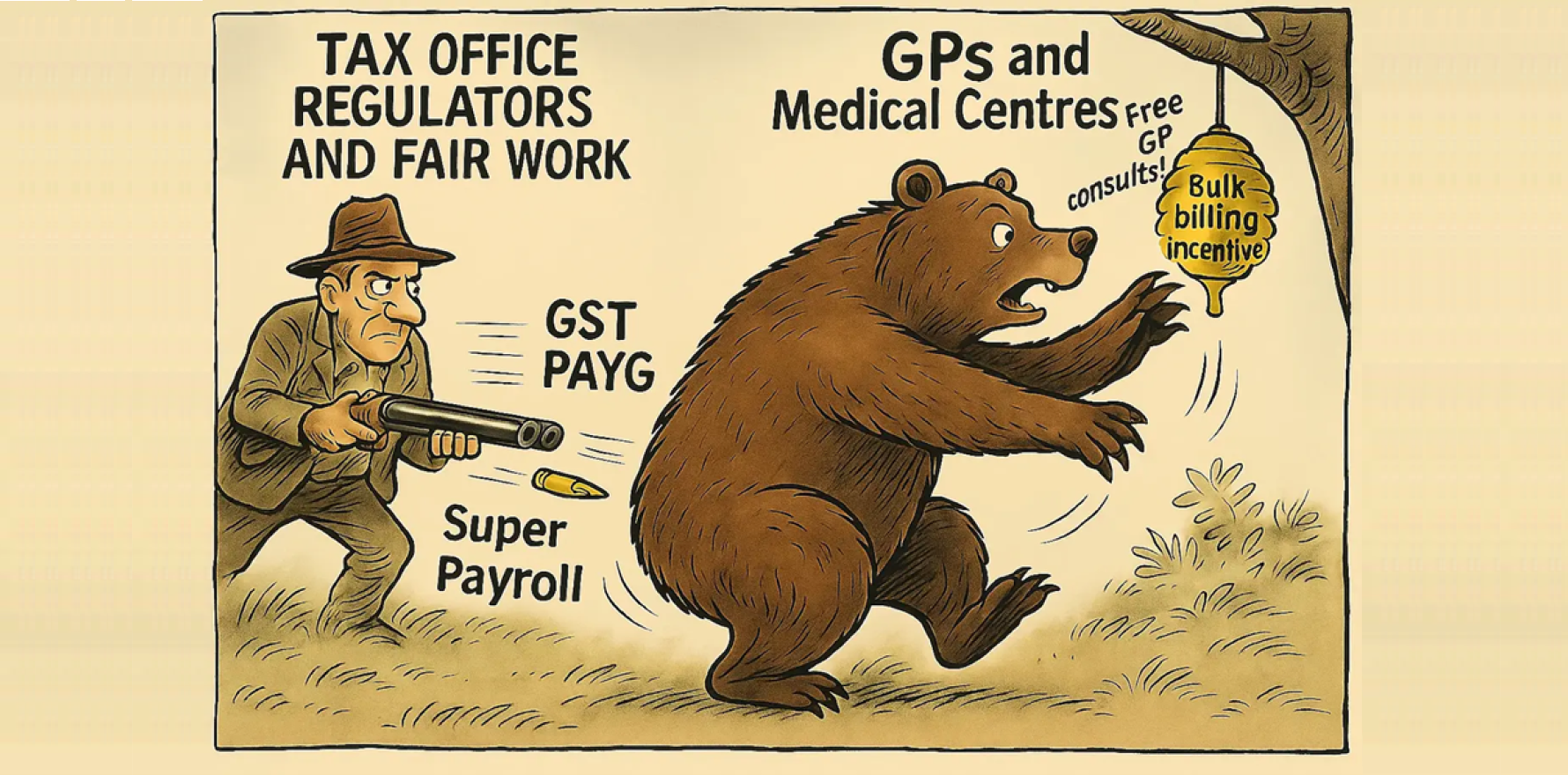

A practice writing a letter or advertising to its patients that it is putting fees up because your local SRO levied you for payroll tax is a great way to earn yourself tax audit.

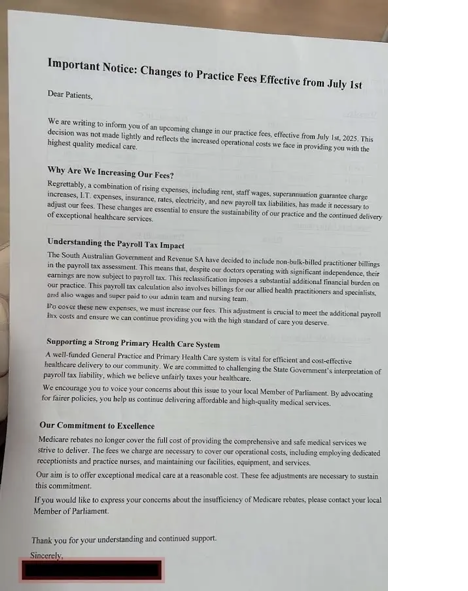

As tempting as it is to shift the blame for mixed billing price hikes onto your local state government, actively promoting to your patients that your fees are going up because of payroll tax is a near-sure way of getting your practice on the radar for a future possible audit.

Healthcare accountant David Dahm is warning that the practice of publicly attempting to offload the blame for price hikes to your patients onto the recent impost of payroll tax by your local state revenue office (SRO), is a poorly thought-out strategy.

“It’s red rag to two increasingly maniacal bulls at this point in time,” Dahm told The Medical Republic this week.

“You’re essentially promoting to both the state payroll offices [and the ATO] that you are operating a business model that is not a tenant doctor model.

“How could you be running a tenant doctor model if you’re advertising on behalf of all of your tenants with a single communication representing them all with an across-the-board price increase?

“SROs will see this as a confirmation that you should be paying payroll tax, when in a lot of circumstances we are finding practices that are but don’t have too based on their structures, but the biggest problem is that the ATO will now put you in that basket for a future look at.

“If you’re not running a genuine tenant-doctor model, and you indicate that to these tax bodies by practice-wide advertising like this, then the ATO is entitled to check if you’ve been paying your contractors tax the right way for the last seven years or so.

“If you haven’t been paying things like super or GST on your contractor commissions, you might find yourself in hot water with the ATO, which is generally a lot more hot than an SRO, especially if you’ve not been careful in how you promote and manage your contractors over the years.”

Dahm, who has a penchant for gory detail when it comes to tax and practice structure, also says that practices who still think they are defendable as tenant/doctor structures who are advertising like this might not have considered that such a promotion could represent a form of price fixing to the ACCC, should they ever look at it carefully.

Related

“There is no longer a GP price-fixing exemption for ‘independent practitioners’, and breaches can result in significant fines, which can be up to $10 million or more per offence,” he wrote in a recent blog post on the topic.

The RACGP price fixing exemption, which had been agreed with the ATO in the early 2000s, apparently lapsed in 2011, at least according to Dahm.

Dahm lists a few basic no-goes for a practice in terms of fees if they don’t want to attract attention:

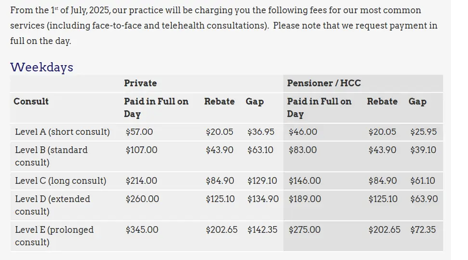

“It is not advisable to present collective fee increases in a way that frames them as purely essential for the organisation’s sustainability, especially if a singular fee table is used to advertise a uniform rise of supposedly independent practitioners,” he says.

There’s an example below:

This choice signals that decisions are top-down rather than independently made by independent practitioners, which may unsettle practitioners who perceive themselves as operating under organisational control rather than as autonomous professionals, said Dahm.

Interestingly, Dahm recommends the strategy whether a practice has caved into paying its local SRO payroll tax or not.

This because he thinks that there is a storm coming – much like the payroll tax storm that has already blown through – in the form of the ATO examining practices for their structure and tax payments to contractors and the like, based on them essentially admitting that their contractors could be deemed as employees through their acceptance of payroll tax payments.

“If you act like one business, you’ll be treated like one,” said Dahm

“Sending reminders or fee changes from a single clinic letterhead or generic account? Every time you do, you provide payroll tax offices and the ATO with ‘audit-proof’ evidence that your practice operates as a single, employer-style business, not as independent professionals.

“The nationwide GP payroll tax non-compliance issue is evidence that nearly 70% of practices in South Australia receive poor or incomplete tax advice.

“Many legal and accounting professionals, as well as some practitioners themselves, tend to oversimplify these requirements, which can result in significant risks and compliance failures.”

Dahm’s full blog post on this topic can be accessed HERE.