Investing in the sector feels like a mug’s game post-ZIRP and covid but some groups are defying negative sentiment.

A few ground rules to keep in mind should you decide to have a go at reading this.

I did a version of this a few years back – Our 11 most valuable digital health companies – which taught me a bit, largely through all the things I got wrong (which was quite a bit, especially on the private groups).

I’m likely to get as much wrong this time in relative terms despite what I’ve learned so keep that in mind (another way of saying that if you took any of this as advice you might need your head read after the fact).

Some ground rules:

- Private company valuations are based on information and intel that runs from pretty good to pretty bad.

- I’ve extracted a few interesting companies out of larger holding companies to feature because they are important for market context when trying to understand what is creating value – for example, InstantScripts, which is now owned by Wesfarmers or Genie which is owned by Citadel.

- Some companies in the list are tech companies and direct healthcare providers with employed or contracted doctors as well but the ones on this list, usually telehealth companies, are substantively providing care via platforms, usually telehealth.

- I’m a non-executive director of MediRecords so I don’t include this company in the list, but I discuss what is publicly known about the group because it’s relevant to understanding value.

- A lot of these companies have at one time or another paid the company that owns our sister publication Health Services Daily money in the form of sponsorship, advertising and delegate and subscription revenue. I list them at the end for transparency.

- I know I’ve missed some companies, so if you are one and you are annoyed at not being in here, let me know.

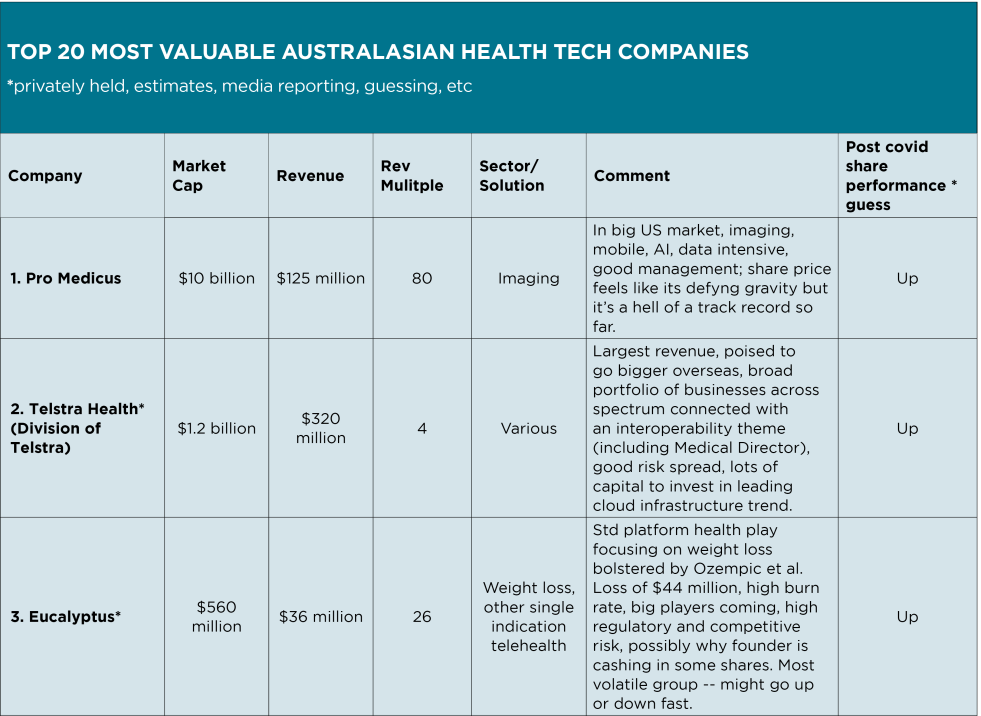

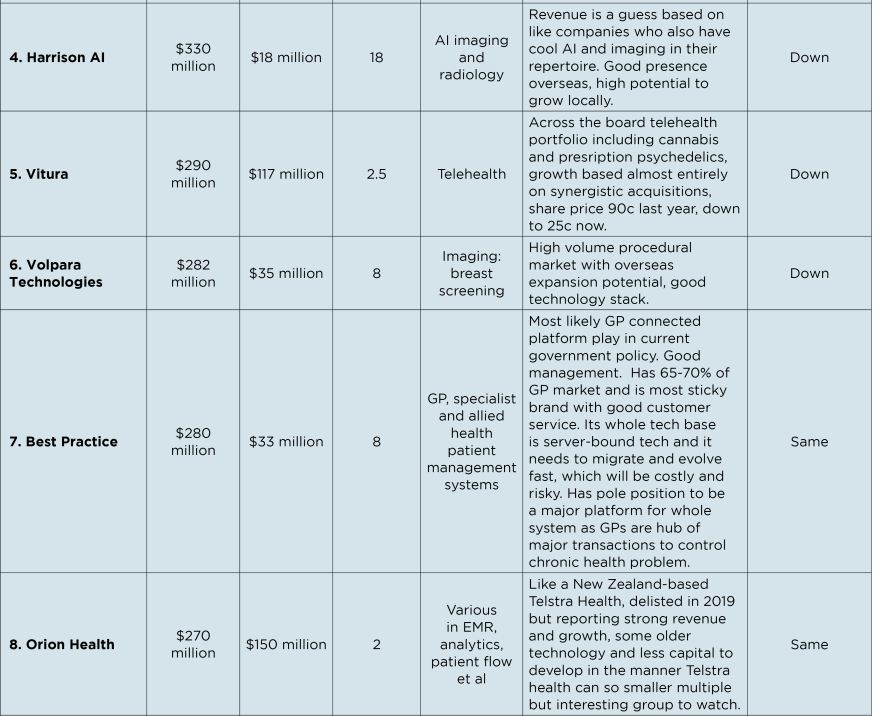

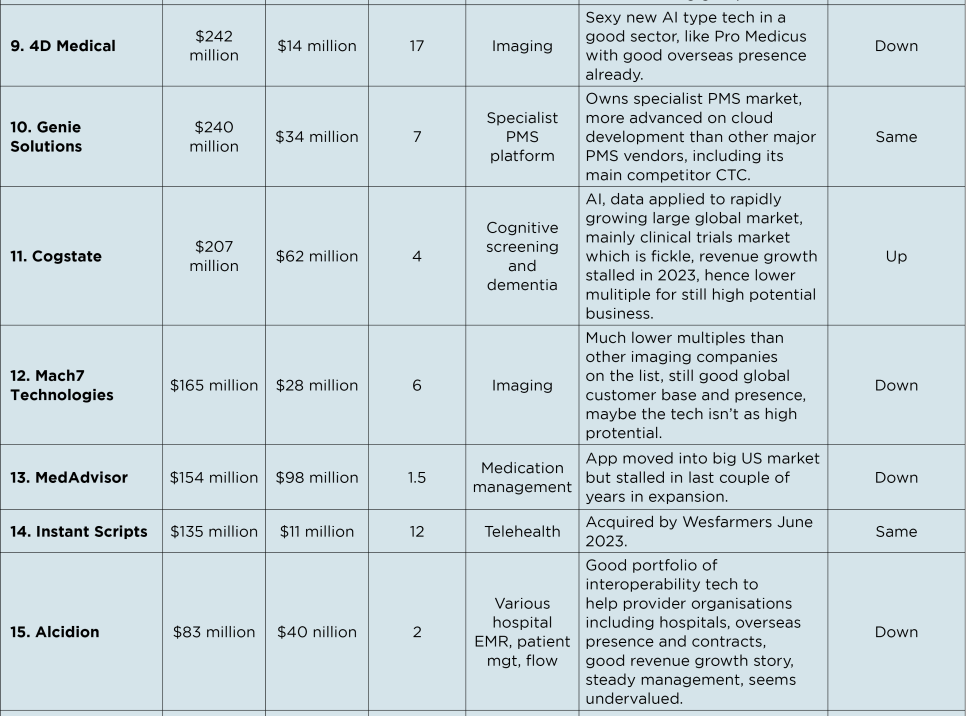

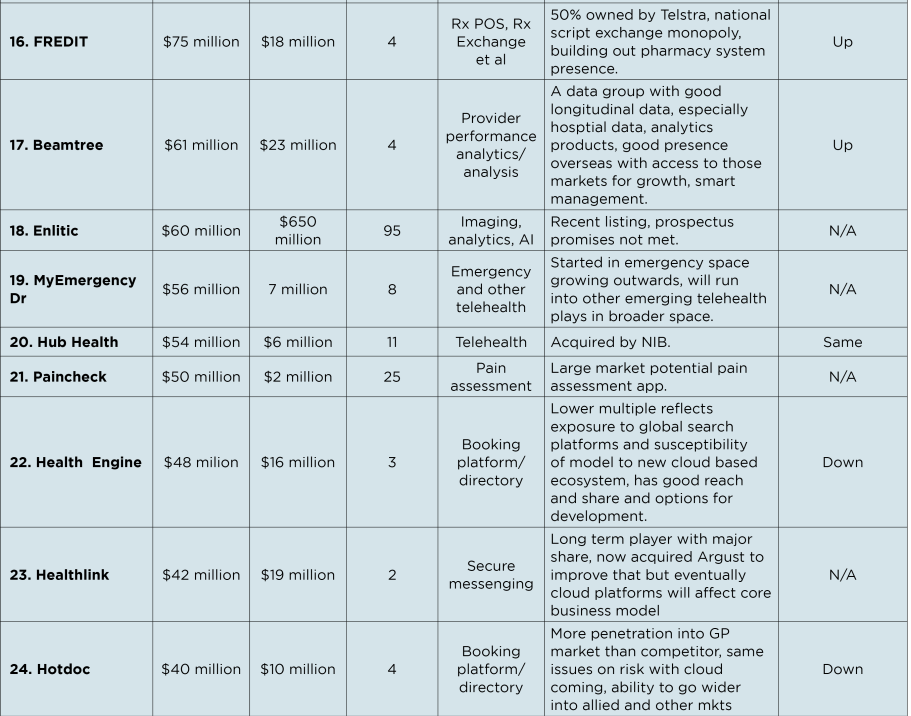

Here’s the basic league table to get things started:

Who survived from the top 11?

Readers might find who remains from the original 11 list interesting as some sort of starting point.

A lot of them made the new list, but only because we extended it out to 30 from 11. Others didn’t make it to this year’s list at all – you can work out which ones.

Only Telstra Health, Best Practice and Genie Solutions actually stayed in the top 11.

Each of these companies is platform-based, has a lot of share of healthcare providers, good long-term market brands (eg, Medical Director inside Telstra Health), access to capital and a strategy that either has them moving fast already or on a path to transitioning their old server-bound platforms and products to being cloud and FHIR-enabled.

Platforms, cloud and FHIR, combined with existing market position, make up some obvious themes on value, but there is a fair bit more going on.

The first thing to note with this list is that a post-covid and ZIRP (zero interest rate policy – or near zero) environment hasn’t been kind to tech companies across the board in terms of valuation and share price (if they are public), but especially so to health tech companies.

Not to pick on anyone in particular, but as an example, Alcidion, which is an interesting company with a hand in data analytics, clinical workflow, EMR integrations and AI, had a share price of around 13c as covid started, 44c at the peak of covid, and now it’s hovering around 5.4c. That’s despite landing the odd good overseas and local contracts and continuing to increase its revenue base robustly.

It’s a similar picture for many of the smaller cap public digital health companies in terms of share price and market cap.

Beamtree is another interesting example.

Putting aside its controversial (mainly to me, it seems) but clever virtual takeover of not-for-profit hospital performance data group Health Roundtable, this group hasn’t done much wrong in terms of building out revenue, a customer base and evolving its strategy through and post-covid. But the market isn’t buying it much. It had a pre-covid price of 15c, it got to a dizzy 66c mid-covid and today it’s struggling to stay at 22c.

Investors clearly got seduced by covid and lots of cheap money but they’re definitely not feeling that love now.

The bigger problem for many of the smaller cap publicly listed groups is valuation multiples, which mid-covid tended to be measured in multiples of revenue of anything from six to 12 times.

In June 2021 Alcidion had a market cap of over $400 million on revenues of just $26 million (a revenue multiple of over 15 times). In 2023 the group reported a very respectable story of growth with revenues just over $40 million but its market cap today is only $76 million, a revenue multiple of less than two.

What is going on there?

One question I have (as a novice) about these sorts of drops in valuation is this:

With the federal government hot-to-trot on moving the dial on interoperability across health through its program of “sharing by default”, and its newly released Digital Health Blueprint and Action Plan 2023–2033, are groups like Alcidion and Beamtree simply undervalued by an investor community that has over-reacted to the tightening money environment? Is the investor community not really understanding the bigger picture emerging around government intent and policy in digital health and the inevitable emergence of the cloud and AI in healthcare in Australia?

I don’t have shares in either of those companies in case you’re wondering about that.

Because of my interest in MediRecords – I am a non-executive director and small shareholder – I have not included them in the list above as I’m not actually allowed to use the information I know about them which is not publicly available – if I gave you revenue and market cap, I would not be guessing.

I will, however, provide this quick short advertisement for them, because the nature of this particular company is relevant to the context of value of most other companies on the list.

MediRecords is a group that, from its starting point, had cloud tech as its baseline. It started about 10 years ago and, in retrospect, its reading of how fast cloud would be adopted in Australia was probably way too optimistic, so it struggled early on to get traction.

MediRecords gets cloud and cloud-based connectivity and that is not actually that common among some of the major established health tech platform groups in Australia over the last 10 years.

That’s because we have had government policy which did not encourage the sort of innovation you’ve seen with cloud in healthcare in the UK, Europe and the US.

In fact, at times government policy, both state and federal, has tended to reinforce large tech platforms that are server-bound, can’t easily communicate with other systems and can result in forms of information-blocking across providers and to patients.

An example would be state-based secure messaging contracts which still have years to run and tend to lock in all the old tech platform vendors.

But that is now changing at speed, which is why MediRecords would make this list if I was allowed to put it in. It is sitting dead-centre of where technology around cloud-based connectivity is heading, and it is attractive technology for any provider who needs to connect providers and patients virtually and who want to futureproof for interoperability around technologies like FHIR.

Suffice to say anyone who knows how to develop sophisticated provider-based solutions technology using cloud architecture and who has a longer-term skillset in technologies like FHIR, are companies to start watching carefully.

It’s still going to take us 5-10 years to get cloud-based provider platforms rolled out and connected, but Australia, which has been way behind in building out such technology, is now on that journey and the government is fully behind it, having got its head around how much improvement the same technology has created in the US and the UK.

If you want the obvious other two trends to watch over cloud and interoperability capability, it’s AI and analytics.

But let’s shift a bit and look at a large cap which is shooting the lights out and see if there is anything that gives us some insight into what is going on.

Pro Medicus is by a mile our most valuable and successful healthtech company, private or public, at a valuation today of over $10 billion. Here is its10-year share price chart. It’s very un-healthcare like.

So, $20 just as covid started with a market cap of $2.75 billion give or take on revenues of about $57 million (revenue multiple of 48-ish), to a $100 share price and a $10 billion market cap on revenues of $125 million (a revenue multiple of about 80).

Possibly Pro Medicus is so big it’s dangerous trying to learn anything from it about most of the other companies on our list, which are, except for Telstra Health, all valued at a long way under $1 billion. But the obvious things that stand out is access to very big overseas markets in a very big and lucrative existing sector – imaging – with cool platforms, data, AI and cloud-based technology thrown in.

It ticks a lot of boxes, but 80 times revenue does seem high given that globally this is now a very competitive sector.

When you read the list some of the small caps that are ticking a few of the same boxes that Pro-Medicus does – apart from them not being in imaging and don’t have global footprints – and their valuations are well under five times revenue, it’s hard to understand what is happening.

It feels like investors are confused post-covid.

In order to get some more insight on what might be happening in terms of value I’ve

split the companies on the list into broad categories of technology in play. Breaking the list into baskets of like companies makes it easier to see how value is getting attached to a sector according to different business models.

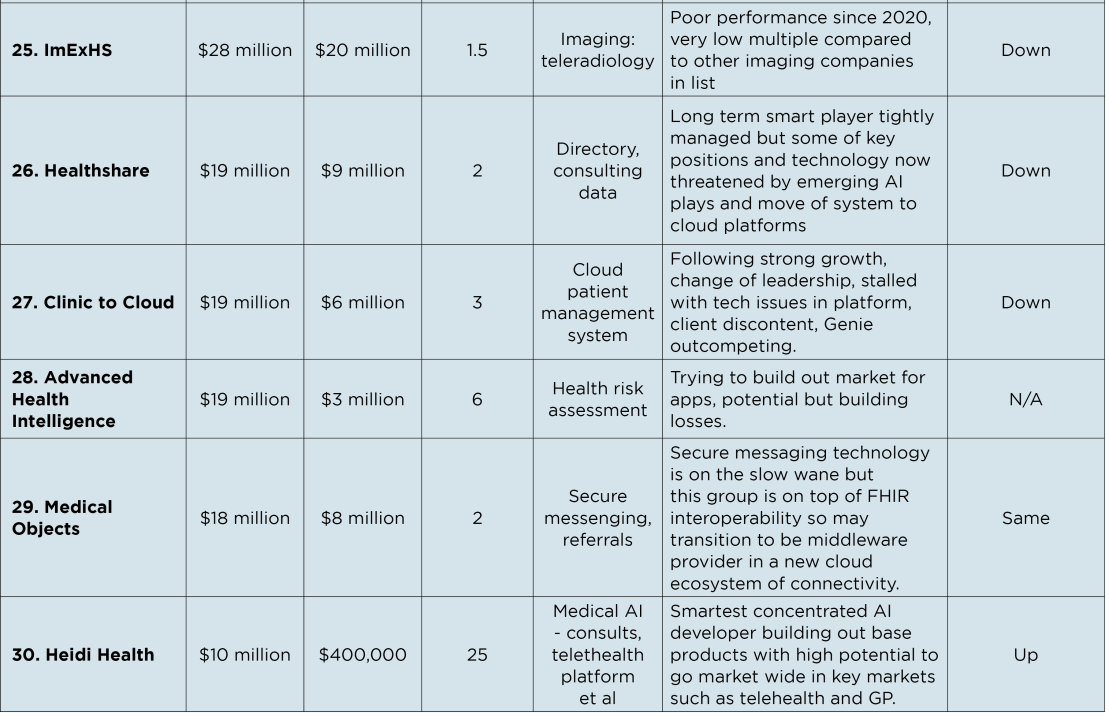

In order of multiples of revenue to market cap from top to bottom, the sectors are imaging, telehealth, AI/analytics (but non-imaging), patient management and other provider platforms moving to cloud (eg, Best Practice, Genie Solutions, Healthshare), and patients apps.

Imaging

Imaging is quite simply a very high-volume huge global market where AI and analytics are increasing the value on the volume significantly because they are data intensive technologies.

Australian companies doing well in the list are Pro Medicus, Harrison AI, Volpara Technologies, 4D Medical Limited and Enlitic.

Enlitic has a revenue multiple to market cap of 95 times revenue. That feels crazy but as I keep saying I’m a novice.

The average of the basket of imaging groups in multiple of revenue to market cap is just over 37 which is so far off the average of every other identified sector it may just be a market way off on its own. Which doesn’t help us understand much of what else is going on in the core healthtech companies in Australia.

Telehealth

Telehealth is the next most valued sector and an interesting one because the current market darling driving the average valuation of telehealth groups is Eucalyptus, which is not so much a health platform as a marketing platform.

The thing about the telehealth category from the get-go is that there isn’t any tech being put in play that is particularly clever, is very healthcare specific in IP terms, or has much of a barrier to entry.

That leads to speculation that most of the current value is around a potential land grab of patients and consolidation, not actual IP in technology.

Eucalyptus is a marketing machine being driven by management who aren’t health professionals at all but are more retail and tech entrepreneurs applying all the digital platform marketing tricks that we’ve seen in big global platform groups like Uber, AirBnB, even Facebook and Google.

The multiple of Eucalyptus is 26 and the average multiple for the basket of telehealth companies in the top 29 is just over 16.

This group of companies is easier to understand in terms of value than the imaging companies.

Almost all the imaging companies have elements of AI and analytics in them which do add value but also tend to make investors speculate in a sometimes silly manner.

The business mode of telehealth has none of the mystery and possible magic of AI and analytics. It is not rocket science, doesn’t really have huge barriers to entry, isn’t scalable in health like other markets such as media and finance, and most of all, is seriously fraught with day-to-day and patient-to-patient regulatory risk.

Just last year Eucalyptus and Instant Scripts faced off in a regulatory adjustment moment that might have been within a hair’s breadth of catastrophe. The Medical Board of Australia decided that asynchronous consulting (via text or email mostly), which most of these fast service telehealth consulting groups were practising at scale, was not safe enough. They had to stop it and make sure that real doctors contacted each patient at least by phone for at least one consult before they were sent “the pills”.

This created a giant extra cost for all these groups and was a clear warning that regulation can kill single model businesses in health pretty quickly. It could have been much worse.

This particular incident might have slowed their growth and valuations down a little, but at the same time it was happening, so was Ozempic, a reasonably new weight-loss drug which came complete with “miracle drug” pre-marketing overseas by Hollywood stars.

It was manna from heaven, particularly for the marketing gurus at Eucalyptus.

But Ozempic points to a pretty big problem for some of these telehealth companies, most of whom only concentrate on high-volume single condition services (although they don’t market themselves this way) such as weight loss, or, increasingly, prescribed versions of cannabis.

Both weight loss and what is effectively recreational legal cannabis are at this point of time, land grabs.

How many patients in Australia want postal order Ozempic or cannabis without the fuss of facing off their GP?

It’s probably a lot but, like Foxtel subscribers, there is a limit and when the natural limit is reached, it’s hard to see what is beyond it. Because, no matter what some of these single condition-focused telehealth groups like to tell us, they aren’t about looking after a patient properly longitudinally for all their complexity (mental health, weight, cardio, diabetes, RA, and so on infinitum) because that simply is not profitable.

That job is being left to GPs.

The plan for these companies is to corner as many of these high-volume single indication, “miracle drug direct” markets they can get, not just weight loss.

But really, weight loss and possibly recreational cannibis is it.

Erectile dysfunction and hair loss are already pretty crowded markets with very little margin in them.

The other problem with telehealth as a sector is what happens when big “other” companies that have a deep existing relationship with the customers of these telehealth groups, a lot of capital and a lot more data, decide they need to add the same direct online services to their portfolio of other online services?

Amazon is coming and Wesfarmers (I love Bunnings, so they have my data and brand vote to send me any of these drugs) already owns Instant Scripts.

Eucalyptus may have already started showing the potential strain of facing off this possible strategic challenge.

It is now starting to market a “high end” concierge style version of their product for the ego-driven and rich end of its current database.

“We’ve identified you as a winner, and special, so we’re going to offer you a whole lot of personalised services with an elite club feel to it, so go ahead, make our day and pay us a premium for something that exists everywhere already (seductive brands you pay for to show people what you’re about).”

Not their marketing words, my translation.

And my response, so far at least:

“No thanks, just the quick and easy Ozempic please, and can you make it a lot cheaper because if I go to my GP and ask them for it, it’s like 50% less for me to get it.”

By the way, my GP seems to actually really know me and like me … hmmm.

An exclusive “rich person’s brand” health club?

That feels very old, not new and innovative: an admission perhaps that there isn’t much left in what really is a very basic mass-marketing platform business model.

But who knows.

I’m not saying these companies aren’t going to grow further or aren’t clever at getting people to part with their money based on ego or insecurity or both, and won’t succeed building a high-end, high-paying database of rich health seekers.

I’m just saying that if you look at the risk profile (health is a terrible market for regulation and government interference), the competition coming and the fact that what’s on offer is really just convenient Ozempic or cannabis, maybe the current valuations are more about these groups’ sharp marketing teams than the business model itself.

AI and analytics

AI and analytics in health have explosive potential upside so it’s not surprising that we have a few candidates on the list.

But if you look at what is going on generally in AI investment you know that there’s quite a bit of FOMO going on, which means you have to really do your homework and understand what the AI proposition is, how it will fit into inevitable regulatory frameworks (they’re coming) and what size of market it will apply to.

Most of the imaging companies in the top sector have AI and analytics as a core part of what they do and we know that the AI in these systems is working and adding a lot of value in a high-volume scalable market.

We haven’t included any of the imaging companies in our AI and analytics top 30 basket.

The multiple of what’s left is nearly eight which seems low but remember we aren’t including any of the imaging and radiology companies in the basket. Most of the ones on the list are either emerging or adapting older business models to leverage of AI hype.

A big part of AI emerging in Australia, which is so far unregulated, is the assessment and recording of patient consults into notes, and then sometimes, the development of things like automated care plans from these consults.

Such technology has massive potential to reduce administrative burden on groups like GPs and specialists and potentially generate new areas of income.

But it’s also fraught with danger.

Currently GPs do take patient notes manually and even put them in their patient management systems. Recording a patient and what they say, then interpreting it with AI might end up as legal dynamite. All these new apps say that the notes or plans generated are always designed for review by the doctor post the consult. But will that end up making more work or less?

AI in EMRs looks like it has quite a way to go.

Provider patient management platforms and related companies

Most people will know the key companies in this basket: Best Practice, Medical Director (part of Telstra Health), Genie Solutions, Clinic to Cloud, FREDIT and so on). I’ve included a few related platform type groups to bolster the basket up and its average multiple of revenue value comes to just over six.

All these companies have very long histories in the market (Medical Director is over 40 years in business now), very big shares of their market (Best Practice potentially has up to 70% of the GP patient management system market now) and mostly, the existing footprints are all technology platforms which we probably should have forced them to change over 10 years ago – server-bound, running lots of bespoke integrations with spaghetti-like means of communicating with the outside world, much of it by another old technology, secure messaging.

But you could probably argue that outside of the imaging category, this might be the most interesting category of companies to watch.

Why?

Because some of them are gatekeepers to the most important providers to the future of an efficient healthcare system that will manage chronic care properly – GPs and then specialists (and some allied health professionals).

One analyst wrote the other day that in 6000 GP practices around the country we seem to have 6000 servers sitting under doctors’ desks largely isolated from the rest of the system – from other doctors in their own practice often, from a practice across the road or across the country, from important allied health partners (eg psychologists), and most important of all, from hospitals.

This of course isn’t quite the case.

These old server-bound systems do still talk across the internet and, via secure messaging, can send referrals to specialists and receive patient summaries from the odd public hospital that has its act together.

But the fact is, it’s still all a massively inefficient mess based on 1980s-style technology and it all needs to shift to more modern cloud-based technologies to create more seamless, real-time and secure interoperability.

Most of these long-term vendors, who probably know more about how our health system works outside of hospitals than anyone else, now realise that they can’t sit on their old tech stacks too much longer and are working on building out much more modern web-based data-sharing workarounds.

This is going to take time and money though.

They are doing this in part because the government is now demanding it of them and saying if you don’t start getting there faster yourselves, we will legislate to force you to get there quicker.

This whole process has already occurred in the US which is a massively bigger, messier and more complex market than Australia, so the government knows we can do it and they are working with these vendors now via new programs, like Sparked, to help.

The big question in terms of value is, what will happen to their business models if they all go fast and suddenly are far more seamlessly interoperable in sharing data with other providers, hospitals, and patients via cloud-based technologies?

Will their value go up because they will be far more valuable hubs of data sharing between all the providers and patients? Or will their value go down because if the government makes them share much more freely, they won’t be able to charge for access to their doctors for various apps and integrations that cluster around their systems like they do now — things like the specialist directory Healthshare and each of the booking engines?

One thing in favour of all the vendors in this basket is they are all parts of tightly held duopolies or as close to it as you can get.

If you can manage your massive share and your clients in the right way, you should be able to find your way through and using your newfound ability to communicate with patients and other providers, release more value.

In the US, existing high market shareholders mostly all survived and thrived through the transition.

But what happened was that a completely new set of companies that helped facilitate all the complexities of connecting all the clusters of providers generating data arose and with that a whole new innovative market sector came about.

There will be some threats to these incumbents if they end up being too slow. Some AI and cloud-based groups with EMR capability will likely present some threat to some of the market.

As an example of some of these incumbents being too slow, nearly all of them have failed to capture the EMR and patient management component of a very rapidly growing virtual care and telehealth market.

They missed this opportunity because in virtual care and telehealth you need cloud-based interoperability for your business models to work, and most of these incumbents simply did not have product that met the specifications of this rapidly growing new health market in Australia.

It’s going to be a very interesting space to watch over the next 10 years. But overall, this basket of companies is possibly undervalued at the moment given their share, access to capital, and reasonably experienced and smart management teams.

Their slowness to respond has been a natural market phenomenon. They haven’t really needed to respond.

Until now.

Smart large-market patient apps

In 2022 more than 350,000 patient health apps were available globally, yet of that huge number only just over 100 were downloaded more than 10 million times, which means making a successful patient app is a really difficult business to be in.

An Australian digital health survey in 2022 found that 32% of patients reported using a patient app at least once in the year, down from 50% a few years earlier, which is probably a post-covid drop. In the US, only 20% of patients say they use a health app.

According to Similar Web, the top three Australian patient apps are Hotdoc – the patient booking engine which is number 23 on our list, Medicare (no surprises there other than Hotdoc beat the government out) and Libre, an app from Abbott to help monitor your glucose patches in real time.

MedAdvisor, a medication management app, which has a much higher market cap and revenue than Hotdoc, comes in at number 6, but MedAdvisor is in the US now, which is a much bigger market.

Similar Web is not entirely reliable on its net stats (better for trends) and it does miss a lot of things – like where is Health Engine in their list (nowhere for some reason).

Notably, the My Health Record is nowhere to be seen either, but that might be because it’s not actually been downloaded that much.

Notably, Paincheck, which is solving a basic problem for a massive market is at 25 times its multiple of revenue, but it’s still in its early stages of development.

This looks like a very difficult market to pick winners in.