The SA SRO is sending most practices who applied for amnesty letters saying they are liable for the tax while the Ts and Cs suggest some might not qualify for the amnesty.

The South Australian State Revenue Office has sent letters to all SA practices that applied for a payroll tax amnesty letters confirming they are, in the view of the agency, liable for payroll tax and that they will need to supply detailed information about tenant doctors, their contracts and pay for the last five years, in order for them to make further assessment.

That suggests that RevenueSA is considering levelling a five-year audit of payroll tax owing for some practices that have applied for amnesty. That might be because RevenueSA deems past tenant doctors as employees, which would mean the practice does not qualify for an amnesty.

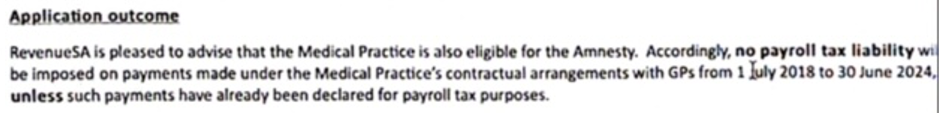

Wording in the letters suggests that while a practice is definitely liable for payroll tax according to the agency, the practice would not be liable for payroll tax going back five years. That excerpt is here:

However, the letter is not an acceptance of amnesty.

While it is stating that the practice is “eligible” for the amnesty, it is explicitly outlined in the amnesty application that if RevenueSA assesses that tenant or contracted doctors working at a practice for the last five years are “deemed as employees” the amnesty may not apply.

“The amnesty is not available for payments to:

- contracted GPs where an exemption applies (because no payroll tax liability would arise if the payment is exempt);

- GPs who are common law employees;

- other medical doctors or allied health professionals;

- other types of contractors.”

(Our emphasis)

A lot will come down now to whether RevenueSA’s reference here is to existing and declared GP employees, or whether RevenueSA is thinking of deeming tenant doctors or contractors as common law employees, which is a fundamental issue at the core of the payroll tax rulings.

Most practices likely thought that the particular issue of whether their tenant doctors were deemed employees or not was one key reason they were being offered an amnesty: to protect them from backwards audit should RevenueSA decide that tenant contractors were in fact employees for the purposes of payroll tax.

The SA branch of the RACGP told TMR that they were aware of the letters and confirmed that in each case RevenueSA had assessed them for being liable for payroll tax at this stage.

“All of those who have contacted us so far have had their application for amnesty accepted but have been told their contracts are relevant for payroll tax, irrespective of flow of funds,” said SA college chair Dr Sian Goodson in a statement.

But the wording of the letter does not indicate that each practice has earned itself an amnesty. The wording says only that each practice is “eligible”, and the letter asks for more information.

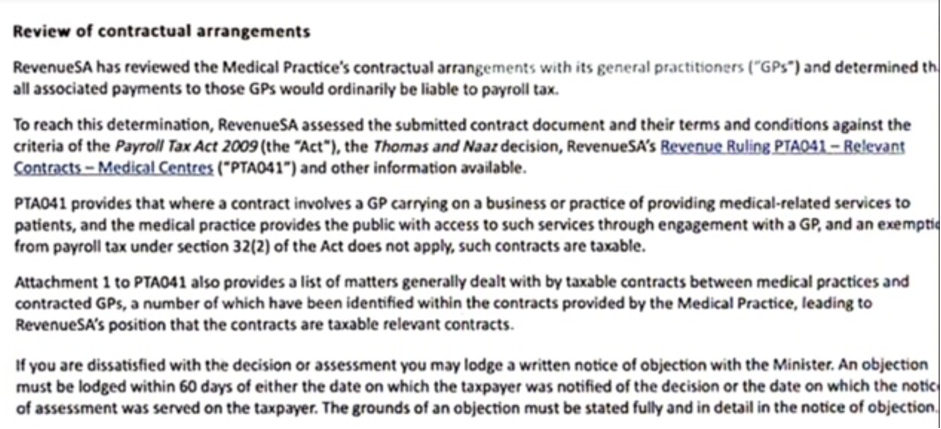

Another excerpt from one of the letters is below:

If RevenueSA does not grant amnesty to some practices based on the original terms and conditions of the amnesty offer (the application) in respect of interpretation of tenant or contract doctors as employees, then some practices may be facing the very real possibility that they have provided all the information that SA Revenue needs to back-audit them and wrap up that audit neatly and legally.

The RACGP seems to think that the possibility exists that this could occur.

Dr Goodson told TMR that:

“It would be very disappointing if RevenueSA was using information supplied via amnesty applications to formulate audit calculations and target practices on payroll tax liabilities; however, it is not clear that this is occurring.

“[W]e will be seeking more information from the government, and I would also encourage any GPs who have received letters of concern to reach out to the RACGP South Australia faculty for support.”

In a blog post on the matter published over the weekend here, principal advisor of HealthAndLife, David Dahm, pointed to the Ts and Cs of the amnesty application and told his readers that it was pretty clear that RevenueSA could invalidate an amnesty if it decided that practice tenant or contract doctors were in fact employees in their eyes.

Mr Dahm’s post says that “one glaring caveat applies” to practices seeking an amnesty and points to the wording of the application published above.

TMR contacted RevenueSA for clarification on the matter today but it is a public holiday in South Australia. We are hoping to have that clarification tomorrow.

Mr Dahm had previously published warnings about both the Queensland and SA amnesties saying to practice owners that they needed to seek good legal advice before applying for the amnesties, at the time pointing to the same clauses around “deemed employees”.

“If the SROs offering these amnesties end up deeming tenant doctors as employees then according to their own application, the amnesty may not be available to practices who have supplied them with a lot of potentially incriminating information,” he told TMR.

“There is a lot of devil in the detail of these amnesties and the SRO rulings and it looks like some people have not read or understood the Ts and Cs but have been scared into making their applications too quickly.

“This is a very complex legal and accounting issue which practice owners can’t manage by themselves … they need to get good advice before they act.

“Looking at the SA letters it feels like some practices may have volunteered themselves to be back audited as once you’ve given an SRO this information you can’t take it back and have certain legal obligations.”

Related

Regardless of whether RevenueSA ends up back auditing some practices that have willingly supplied them information based on the amnesty offer, Dr Goodson says that just imposing payroll tax moving forward has the potential to “cripple primary care in my home state”.

“The clock is ticking, because when the amnesty ends on 1 July this year, many practices that are subject to new payroll tax liabilities will be forced to raise patient fees, reduce bulk billing, or close their doors for good,” he told TMR.

“This will have a dire impact on our entire health system, with patients avoiding general practice care and turning up to already under-pressure hospital emergency departments with conditions that could and should have been managed by their usual GP.

“We once again urge the government to listen carefully to our concerns and follow the lead of other jurisdictions including Queensland to devise a practicable solution that halts the imminent collapse of bulk billing in South Australia”.