Here are the types of personal risk insurance available and how to determine the level of cover required.

Personal risk insurances can be confusing, even for highly educated general practitioners and medical specialists.

As a financial adviser that works closely with clients in the medical industry, I am often asked how to select the correct insurance and required levels of cover. Another important consideration is how to structure for tax efficiency.

Types of insurance

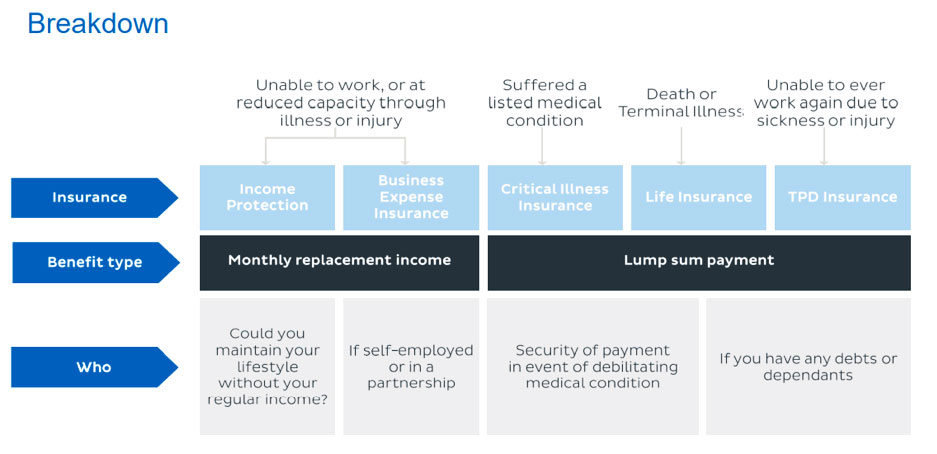

There are four main types of personal risk insurance.

Life insurance – paid upon death as a lump sum.

Total and permanent disability (any occupation or own occupation) – pays a lump sum upon the coverholder becoming permanently disabled and being unable to return to work. “Any occupation” covers you if you can’t go back to any job. “Own occupation” covers you if you can’t go back to work in your usual occupation or field of employment.

Trauma – pays a lump sum to cover time off work for a serious medical event such as heart attack, stroke or cancer.

Income Protection – pays up to 70% of a coverholder’s pre-illness/injury income for a defined period. Most policies allow for a two-year benefit period to cover time away from your own occupation and a benefit period of up to age 65 on any occupation. There are still two insurers who provide cover against time off your own occupation up to age 65 for medical practitioners.

Can I set and forget, or should I regularly review my policies?

It’s important to regularly review personal insurances as you progress through different life stages or experience a significant event such as a new mortgage, additional children or an increase in personal income.

The four types of cover work together to protect doctors and their families in the event of illness or injury. It’s important to consider all four types of insurance early on in your career, before you have accumulated substantial assets. Below is a summary of the way the policies work together.

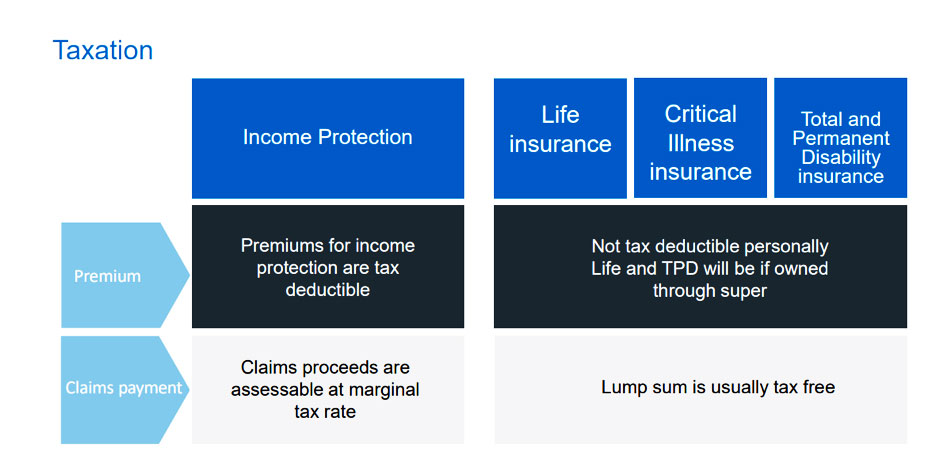

Structuring for tax efficiency

Each client is different and there is no one-size-fits-all approach to structuring personal risk insurances. In most cases, it’s good to begin with the structure below which optimises tax efficiencies, and then amend for your personal circumstances.

Your life insurance should be paid out of your superannuation fund, which makes the premiums tax-deductible and payouts to a spouse, or child under the age of 18, are generally tax-free. You can also set up a tax-efficient pension within your superannuation fund for a child or spouse.

TPD should be paid partly through your superannuation and partly through personal funds. The TPD paid through superannuation is tax-deductible, whereas that which is paid from personal funds is not. “Any occupation” is paid through super whereas “own occupation” is not and hence is not tax-deductible. While own occupation offers a more comprehensive cover, it can be quite costly, especially for those in the higher tax brackets. A hybrid policy is a good choice because it isolates those occupations that would be covered by someone’s own occupation cover and pays those through superannuation, then only pays the occupation that would ordinarily be covered by an own occupation policy outside of superannuation. This optimises the tax deductibility.

Trauma insurance should be paid through personal funds and is not tax-deductible, but any payout is tax-free.

Income protection should be paid personally and is tax-deductible; however, any payment is taxed as regular income.

Determining levels of cover

Determining the most appropriate level of cover is time consuming, but taking the time to do this properly with a professional adviser will ensure that you have adequate and tax-effective cover in place. We generally ask clients to fill out an insurance needs analysis questionnaire and then follow up with a phone call to discuss.

We consider various scenarios and ascertain the client’s assets/income and priorities (for example, paying school fees). We then determine levels of cover by considering the below.

What level of each different type of cover will be required to do:

- Pay debts

- Replace cashflow and provide for family when wage is gone

- Fund education

- Fund medical expenses

- Make house alterations

- Fund an income protection top-up

- Fund post-illness/injury income requirements

- Replace income when required. For example, some people will have a 30-day waiting period before they begin to receive their income protection payments. However, it’s worthwhile to consider your sick and personal leave accumulations and your amount of savings before determining the waiting period/start date on your policy because you can vary this start date which can also make the cover more affordable.

Determining the most appropriate insurance provider

Just like with medical indemnity insurance, there are different nuances with each of the personal risk insurance policies. And, as the policies are health assessed, if you have a pre-existing medical condition you may be offered different terms by different insurers. A professional financial adviser will liaise with the insurers and negotiate the best terms for you.

Scott Montefiore is director, wealth advisory at William Buck.

Please note that the content in this article is general in nature. For advice tailored to your circumstances, please contact an experienced advisor.